Key Takeaways

- Understanding and implementing secure credit card payment processing can significantly increase online sales and enhance customer trust.

- Choosing the right payment processor involves considering transaction fees, security measures, and available payment options to fit business needs.

- Optimizing the checkout process with multiple payment options and a streamlined design reduces cart abandonment and improves customer satisfaction.

Understanding Credit Card Payments

Accepting credit card payments broadens your customer base and boosts sales. To do so, you need a secure payment processing system that can handle the complexities of online transactions. The type of website, business registration, monthly sales volume, and targeted customer segments determine the best approach to accept credit cards for online payments.

Modern payment providers have made the credit card payment process secure and efficient, ensuring that customers feel safe when they accept payments online on your payment method site.

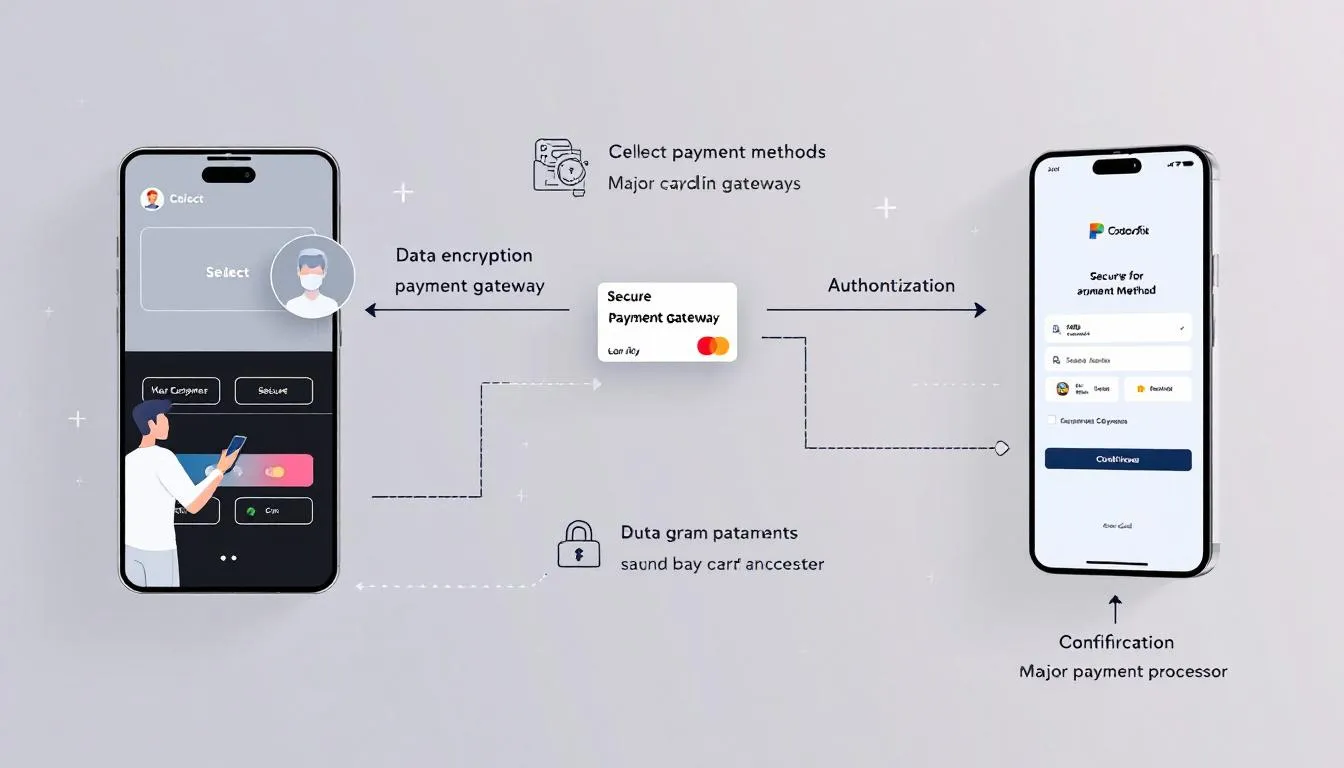

How Credit Card Transactions Work

A straightforward credit card payment process typically involves:

- Capturing card details when a customer presents their card.

- Routing the information through secure payment networks.

- Sending the information to the card issuer for approval.

- Completing the transaction if approved.

- Sending funds to the merchant account, typically within one to two business days, as part of the credit card processing card processing.

During this process, customer credit card information is scrambled and routed through secure payment networks to ensure data protection. This secure transaction method uses HTTPS/TLS encryption to protect sensitive information. The efficiency of this process means that credit card payments often take only a few seconds to complete.

Merchants can access the funds after a couple of business days following the transaction, once the day’s batch has been authenticated and deposited into the merchant account. Familiarity with these steps ensures a smooth payment process and enhances the customer experience.

Benefits of Accepting Credit Cards Online

Online credit card payments can significantly increase sales by catering to consumer preferences for digital transactions. Businesses that accept credit card payments and accept online payments have a greater chance of capturing consumers, as 85% of consumers prefer to pay with credit cards. This preference underscores the need to offer this payment option to meet consumer expectations and boost sales.

Consumers prefer credit card payments over cash transactions due to protection from unauthorized charges. Accepting credit card payments enables businesses to receive payments from global customers, expanding market reach and enhancing convenience. Debit cards are also a popular option for many consumers.

The benefits of accepting credit card payments include increased sales, enhanced customer convenience, and the ability to reach a global audience.

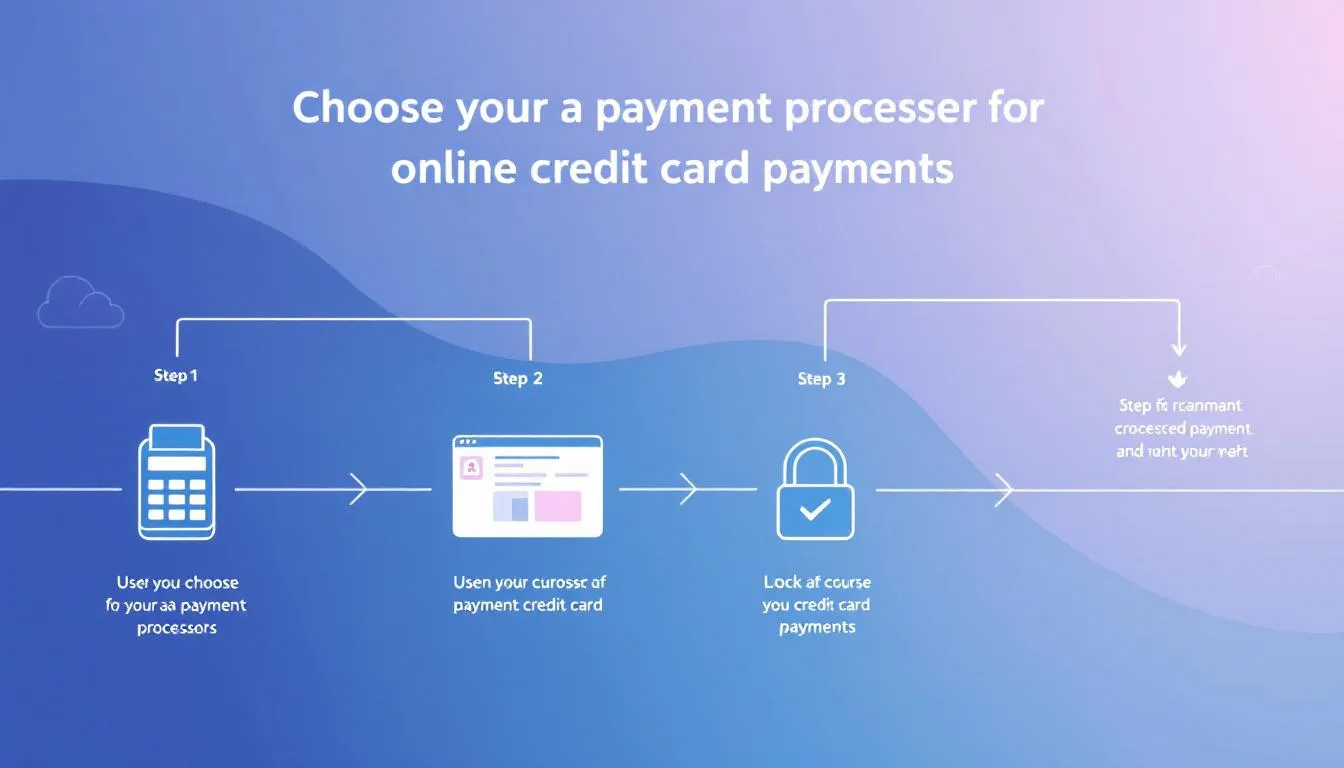

Choosing the Right Payment Processor

Selecting the right payment processor enhances customer convenience and transaction security for modern online businesses. With card payments accounting for over 60% of consumer transactions in the U.S., the role of payment processing cannot be overstated. Factors to consider when selecting a payment processor include:

- Transaction fees

- Security measures

- Supported payment methods

- Customer support

Payment processors include dedicated merchant account providers, merchant aggregators, and payment gateways not requiring a merchant account. Each business type has its advantages and considerations, depending on your payment provider business needs.

Additionally, PCI compliance fees can vary widely between credit card processors, with some imposing fines for non-compliance. Choose a payment processor that aligns with your business requirements and offers transparent pricing.

Comparing Payment Processors

When comparing payment processors, consider their fee structures and flexibility. For example, Helcim offers:

- Charges of 0.5% and 25 cents per online transaction for businesses with $50,000 or less in monthly card transactions.

- Interchange-plus pricing, which can be more transparent compared to other fee structures.

- No contract requirement for its services, allowing for more flexibility.

Many payment processors do not charge setup fees, but some may impose them depending on the account. Verify potential setup fees with each payment processor to avoid unexpected costs. Understanding payment processor costs helps business owners make informed financial decisions and choose the best payment solution.

Setting Up a Merchant Account

Setting up a merchant account is crucial for accepting credit card payments. This typically involves filling out a form that includes business details and may involve a verification process. After submitting your documentation, the payment processor reviews it and may request more information. High-risk businesses that have elevated fraud rates usually require individual merchant accounts. This also applies to businesses selling items that are federally regulated.

Before accepting credit card payments, you need to:

- Register or apply for an account.

- Provide business information when creating an account with a payment processor.

- Possibly undergo an application process and a verification process.

Once you’ve shopped for the best deal in accepting credit card payments, gather your documents and open an account. Ensure the merchant account and its associated gateway are compatible for successful payment processing.

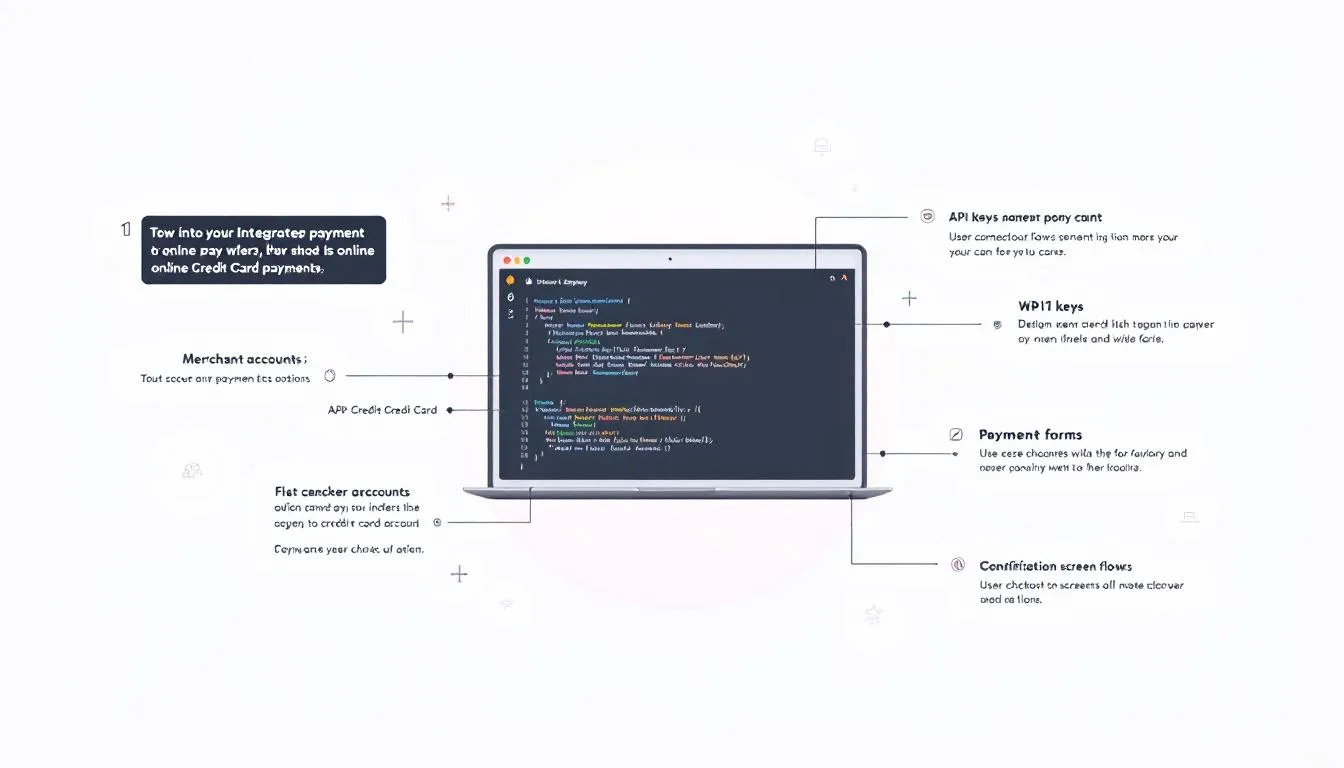

Integrating the Payment Gateway

Before going live, integrate the payment gateway on your website and conduct tests. Most payment processors provide pre-built plugins or APIs for easier integration, which can simplify the process significantly. Ensure that you have a paid plan with your chosen payment processor to access all features.

Integration procedures may differ depending on the specific payment gateway chosen and the platform of the website. Utilizing a testing mode can help ensure the payment system is functioning correctly before launch.

Using Plugins for Integration

Plugins can simplify the process of integrating payment gateways for various e-commerce platforms. Many platforms provide a variety of plugins that reduce the need for coding, making the integration process more straightforward.

These plugins are designed to work seamlessly with popular e-commerce platforms, allowing businesses to quickly set up and start accepting payments online using a pos system.

Custom API Integration

Custom API integration allows for tailored payment processing solutions, accommodating unique business needs. This approach offers more flexibility and can be customized to fit specific business requirements and enhance user experience.

Custom API integrations suit businesses with specific workflows unmet by pre-built plugins, offering a personalized solution.

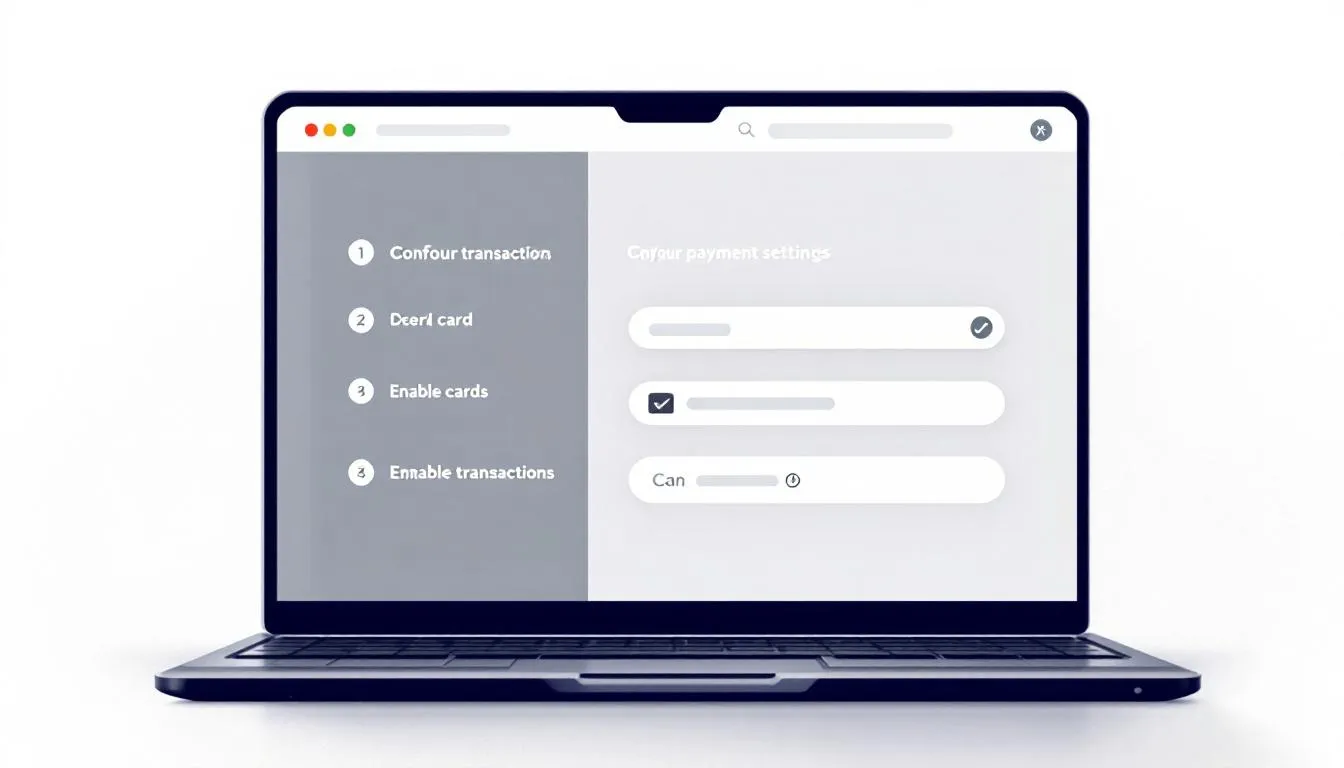

Configuring Payment Settings

Configuring payment settings caters to customer preferences and boosts conversions. Offering a variety of payment options during checkout can improve the overall customer experience. A full suite of payment options, including credit cards, digital wallets, and alternative payment methods, can help attract more customers and enhance their shopping experience.

Reviewing and updating payment methods based on customer feedback optimizes payment settings and keeps your business competitive. Integrating various payment options caters to different customer preferences and increases sales completion.

Currency and Payment Methods

Businesses can configure multiple currencies and various payment options, including subscription models and Buy Now Pay Later (BNPL) solutions. Accepted payment methods can include major debit/credit cards, Apple Pay, Google Pay, PayPal, and BNPL solutions like Affirm and Afterpay. Offering digital wallets alongside traditional credit cards enhances checkout convenience.

PayPal can be connected to your site either by using plugins like PayPal for WooCommerce or by connecting an existing PayPal account externally. Offering a range of payment methods can cater to a diverse customer base, making it easier for customers to complete transactions and increasing overall satisfaction.

Security Measures

Robust security measures protect sensitive customer information. PCI compliance ensures secure handling of payment card data. HTTPS or TLS encryption protects sensitive information during online payments.

PCI compliance involves adhering to established security standards to protect cardholder data, which is vital for maintaining customer trust.

Testing Your Payment System

Testing the integration ensures the payment gateway functions correctly before launch. It’s essential to conduct thorough testing of the payment gateway to ensure functionality and reliability. Payment testing ensures that transactions are processed correctly, enhancing reliability and customer trust.

Testing mode evaluates the payment system’s functionality without real transactions.

Simulating Transactions

Using test modes helps in identifying and resolving potential issues before going live. Key aspects include:

- Simulated transactions detect potential issues in the payment process before real transactions.

- Simulating transactions enables developers to identify potential issues by using specific test values that mimic real payment scenarios.

- Utilizing test cards enables the simulation of various payment scenarios, including successful and declined transactions.

Identifying and fixing issues during testing ensures a smoother transaction process upon going live. This proactive approach can prevent potential problems that could disrupt the payment process and negatively impact the customer experience.

Troubleshooting Common Issues

Common problems during testing include incorrect configurations or data that can hinder transaction processing and user experience. Technical issues like website crashes can lead to lost sales, customer frustration, and damage to reputation.

Promptly addressing issues during testing ensures a smoother launch and better customer satisfaction.

Launching and Managing Payments

Finalize your payment setup by switching to live mode to enable real transactions. Utilize dashboards and analytics tools to monitor transactions, track sales, and manage disputes effectively.

This ongoing management ensures that your payment system remains reliable and efficient, providing a seamless experience for your customers.

Switching to Live Mode

After thorough testing of the payment system, businesses can transition to live mode to begin processing real transactions. Before launching, it is essential to switch your payment system to live mode to process real transactions.

The final step to enable live transactions on a website is to switch the payment system to live mode after thorough testing.

Monitoring Transactions

Payment processors provide dashboards or analytics tools to help businesses manage transactions effectively. An integrated payment dashboard lets you review payments, handle refunds and chargebacks, and schedule payouts. Regular transaction monitoring helps process payments, manage sales, disputes, and overall business performance efficiently.

To manage your transactions effectively, it is important to regularly monitor transaction volume, handle disputes or chargebacks promptly, and track sales performance. This proactive approach helps in maintaining a smooth payment process and ensures customer satisfaction.

Ensuring Compliance and Handling Fees

Compliance and effective fee management are crucial for a smooth payment process. Common risks associated with online transactions include:

- Fraud

- Chargebacks

- Technical issues

- Regulatory compliance

Transaction fees can vary and may include:

- Processing fees

- Chargeback fees

- Interchange fees

Regulatory Compliance

Regulatory compliance ensures the security and protection of sensitive customer information when handling credit card data. The Payment Card Industry Data Security Standard (PCI DSS) is a set of regulations that businesses must follow to ensure data security compliance. PCI DSS compliance involves completing a Self-Assessment Questionnaire annually, and failing to maintain compliance may result in PCI non-compliance fees from credit card processors.

Investing in robust security protocols safeguards sensitive customer information and maintains business trust. Adhering to regulatory compliance protects your business from legal issues and enhances customer confidence in your payment system.

Understanding Fees

There are various fees associated with accepting credit card payments, including processing costs, chargeback fees, and PCI compliance fees. Key fees include interchange fees, assessment fees, and processor markup, which together form the credit card transaction fees. These fees can vary depending on the fee structure chosen, such as flat-rate or interchange-plus.

PCI non-compliance fees may incur charge monthly fees that can vary based on the credit card processor, typically ranging from $19.99 to $125.00. Understanding and managing these fixed fee charges maintains profitability and ensures a smooth payment process. Additionally, a monthly fee may also apply in certain circumstances.

Businesses can estimate their cost effective processing costs by using calculators based on their average monthly sales volume.

Optimizing Your Checkout Process

Implementing a seamless checkout can significantly decrease cart abandonment rates. Key factors include:

- Customizing the checkout to suit customers helps reduce cart abandonment.

- Streamlining the checkout process increases completion rates.

- Frequent payment declines signal underlying issues that need addressing to maintain customer satisfaction.

Regular transaction performance tracking helps businesses identify and address customer disputes or chargebacks effectively. Utilizing integrated dashboards allows you to efficiently manage transaction data and respond to disputes.

To achieve this, consider Good Solutions Tech, a reliable partner in optimizing your checkout process, ensuring that your customers enjoy a smooth and hassle-free payment experience.

Streamlined Checkout Design

A simplified checkout experience can lead to higher completion rates by minimizing customer frustration. Simplifying the checkout page layout enhances user experience and boosts conversion rates. Key ways to simplify the checkout process include:

- Simplifying the checkout page layout to enhance user experience

- Integrating saved customer information to expedite the checkout process

- Making the process more convenient for repeat customers

A guest checkout option decreases cart abandonment by not forcing users to create accounts. A well-designed checkout process maintains high customer satisfaction and repeat business.

For assistance in creating a streamlined checkout design, Good Solutions Tech offers expert services to help you optimize your online store.

Offering Multiple Payment Options

Offering a variety of flexible payment options encourages more customers to complete transactions using methods they trust and prefer. Common payment options to offer include:

- Credit cards

- Apple Pay

- Google Pay

- Buy Now Pay Later (BNPL) solutions

Incorporating widely-used digital wallets and contactless payments can enhance customer convenience during purchases.

Businesses should provide a suite of convenient payment options to make purchasing easier for many customers pay, ultimately leading to higher satisfaction and retention. Offering multiple payment options is crucial to cater to different customer preferences, especially when customers are paying.

For a comprehensive payment solution, consider partnering with Good Solutions Tech to ensure your checkout process meets the needs of diverse customers.

Summary

Setting up credit card payments on your website is a multi-step process that involves understanding credit card transactions, choosing the right payment processor, integrating the payment gateway, and configuring payment settings. By following these steps, you can ensure a smooth and secure payment process that enhances customer satisfaction and boosts sales. Regularly testing and monitoring your payment system, ensuring compliance, and managing fees are essential for maintaining a reliable and efficient payment process. Embrace these practices to optimize your online store and provide a seamless shopping experience for your customers.

Frequently Asked Questions

What are the benefits of accepting credit card payments online?

Accepting credit card payments online can greatly boost your sales and improve customer convenience, while also allowing you to reach a global audience. Embracing this payment method can lead to increased business growth and customer satisfaction.

How do I choose the right payment processor for my business?

To choose the right payment processor for your business, evaluate transaction fees, security measures, supported payment methods, and the quality of customer support. This thorough assessment will help you make an informed decision that aligns with your business needs.

What is PCI compliance, and why is it important?

PCI compliance is essential for safeguarding cardholder data and maintaining the security of sensitive customer information during credit card transactions. Adhering to these standards helps prevent data breaches and builds trust with customers.

How can I optimize my checkout process to reduce cart abandonment?

To effectively reduce cart abandonment, simplify the checkout layout and allow guest checkout options, while also offering a variety of payment methods. These strategies create a smoother and more user-friendly experience for customers.

What types of fees should I expect when accepting credit card payments?

When accepting credit card payments, you should anticipate transaction fees, chargeback fees, PCI compliance fees, and potential setup fees. Effectively managing these costs is crucial for your business’s profitability.

#AcceptCreditCards #OnlinePayments #PaymentProcessing #MerchantAccount #PaymentGateway #SecureTransactions #PCICompliance #PaymentProcessors #CheckoutOptimization #MultiplePaymentOptions #PaymentSecurity #TestingPayments #Troubleshooting #ManagePayments #ProcessingFees #DigitalWallets #BNPL #GuestCheckout #CartAbandonment #ApplePay #GooglePay #EcommercePayments #WebsitePayments #GoodSolutionsTech #SmallBusinessPayments